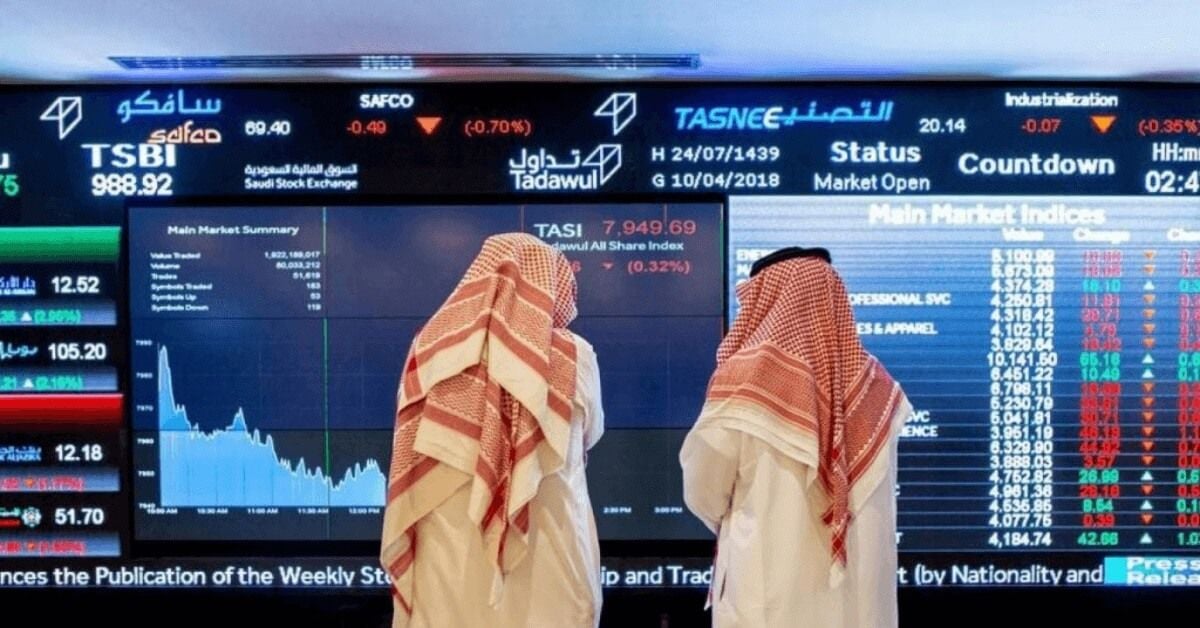

Here are 10 of the best Saudi stocks to watch in 2026 and beyond, as well as an alternative to chasing Saudi stocks to invest.

There are literally thousands of publicly traded companies you can invest in, not to mention the many exchange-traded funds (ETFs) you can buy, so it's not surprising many investors don't know where to begin.

Before we get to the stocks, let's acknowledge three caveats:

- Choosing the best Saudi stocks to invest in today heavily depends on your personal financial situation. To get a feel for where you stand, read our guide on how to invest in stocks. It walks you through the process of screening stocks, allocating assets, and when it makes sense to buy shares of stock.

- These stocks are considered long-term investments. If inflation stays elevated longer than expected, interest rates continue to rise, the uncertainty facing the banking system in 2023 persists, or some large economies fall into a deep recession, it's entirely possible that most or all of these could decline in the near term.

- The list below isn't meant to be exhaustive one. Instead, they're long-term Saudi stocks that worth considering for 2023 and beyond. One of the one-step ways to diversify your holdings is to build the core of your portfolio around something like the iShares MSCI Saudi Arabia ETF (KSA).

Let's get to the list of the 10 best Saudi stocks to buy now and hold for the long term, based on analysts' coverage and the latest Saudi stock price predictions.

The 10 Best Saudi Stocks to Invest in February 2026

Some of the best Saudi stocks to buy in 2026 take into consideration strong business fundamentals, robust earnings profiles, and the capacity to rebound once the market regains momentum.

- Aramco (Tadawul: 2222)

- Al Rajhi (Tadawul: 1120)

- Alahli Tadawul: 1180)

- SABIC (Tadawul: 2010)

- STC (Tadawul: 7010)

- Maaden (Tadawul: 1211)

- RIYAD (Tadawul: 1010)

- Albilad (Tadawul: 1140)

- Alinma (Tadawul: 1150)

- Saudi Electricity (Tadawul: 5110)

The Saudi stocks highlighted on this list are sourced from industry analysts, but they may not be a perfect fit for your portfolio. Before you decide to purchase any of Saudi stocks listed based on third party price predictions, do plenty of research to ensure they are aligned with your financial goals and risk tolerance. You should know also the Past performance and forecasts are not reliable indicators of future results.

1. Aramco stock (Tadawul: 2222) - Overall, one of the best Saudi stocks to hold

Aramco is a global petroleum and gas company based in Saudi Arabia. It went public in 2019 with the largest IPO in history. Today, Aramco is listed on the Saudi Stock Exchange and is among the world's most valuable companies and one of the best Saudi stocks. Aramco shares are held by a diverse range of investors and are included in various stock indices and some of the best ETFs for 2026.

Saudi Arabian Oil's revenue and earnings are forecast to decline at 3.8% and 0.5% per annum respectively. EPS is expected to decline by 0.3% per annum. Return on equity is forecast to be 25.9% in 3 years.

Aramco, a company that pays dividends, currently offers a yield of 5.65%, which is adequately supported by its earnings.

Analysts suggest that the price of Aramco stock will drop for the remainder of 2024 compared to the current price, ending the year at an average price of 29.694 SAR.

2. Al Rajhi stocks (Tadawul: 1120) - The most popular Saudi bank stocks

Al Rajhi Bank, one of the largest Islamic banks globally, offers a wide range of banking and investment services in Saudi Arabia. Its shares (ticker symbol: 1120) listed on the Saudi Stock Exchange are favored by domestic and international investors. Considered one of the best stocks in the Saudi market, it is a popular holding in international ETFs tracking the Saudi stock market, such as the iShares MSCI Saudi Arabia ETF (KSA).

Al Rajhi Banking and Investment is forecast to grow earnings and revenue by 11.2% and 11% per annum respectively. EPS is expected to grow by 11.9% per annum. Return on equity is forecast to be 20.4% in 3 years.

Al Rajhi Banking and Investment, a company that pays dividends, currently offers a yield of 2.97% which is well covered by earnings.

Analysts suggest that the price of Al Rajhi stock will decline in 2024 compared to the current price, ending the year at an average price of 78.578 SAR. And it reaches 137.336 SAR in 2028

3. Alahli stocks (Tadawul: 1180) - One of the best Saudi bank stocks to watch in 2026

Established in 1953, SNB is a leading financial institution offering diverse banking and investment services. With its shares listed as "1180" on the Saudi Stock Exchange, this Saudi stock is widely held by domestic and international investors, and its inclusion in global ETFs highlights its popularity in the Middle Eastern banking sector.

Saudi National Bank is forecast to grow earnings and revenue by 1.9% and 8.1% per annum respectively. EPS is expected to grow by 7.7% per annum. Return on equity is forecast to be 12.8% in 3 years.

Saudi National Bank is a dividend-paying company with a current yield of 4.74% that is well covered by earnings.

Analysts suggest that the price of Alahli stock will decline in 2024 compared to the current price, ending the year at an average price of 15.934 SAR.

4. SABIC stocks (Tadawul: 2010) - One of the best Saudi stocks in the chemical industry

With a strong financial performance and a diverse product portfolio, SABIC became a top Saudi stock in the last few years. The strategic global partnerships solidified its position in the chemical sector and attracted investors' attention worldwide.

Saudi Basic Industries is forecast to grow earnings and revenue by 58.3% and 5% per annum respectively. EPS is expected to grow by 53.3% per annum. Return on equity is forecast to be 8.6% in 3 years.

SABIC is a company that pays dividends and currently offers a yield of 4.06%.

Analysts suggest that the price of SABIC stock will decline in 2024 compared to the current price, ending the year at an average price of 79.701 SAR.

5. STC stocks (Tadawul: 7010) - one of the best telecom stocks in the Saudi markets

Saudi Telecommunication Company is the digital enabler of telecommunications services in the Kingdom of Saudi Arabia, and among the top operators in the Middle East. Expanding operations and investments in 5G networks, boosted STC stock price in the last years among other considerations, and made it one of the most popular Saudi stocks for local and international funds.

Saudi Telecom is forecast to grow earnings and revenue by 4.8% and 5.8% per annum respectively. EPS is expected to grow by 4.5% per annum. Return on equity is forecast to be 16.9% in 3 years.

“Tadawul:7010” is a dividend-paying company with a current yield of 4.28% that is well covered by earnings.

Analysts suggest that the price of STC stock will drop in 2024 compared to the current price, ending the year at an average price of 10.239 SAR.

6. Maaden stocks (Tadawul: 1211) - one of the best Saudi mining stock

Ma'aden, a Saudi mining and metals company founded in 1997, operates globally in various segments, including mining, infrastructure, aluminum, and phosphate. With a diverse product portfolio and focus on innovation, sustainability, and strategic partnerships, the company maintains its leading position in the industry while expanding its operations worldwide. Ma'aden stock shows a stable uptrend and become one of the most desired Saudi stocks.

Saudi Arabian Mining Company (Ma'aden) is forecast to grow earnings and revenue by 30.2% and 6.1% per annum respectively. EPS is expected to grow by 30.1% per annum. Return on equity is forecast to be 9.1% in 3 years.

Analysts suggest that the price of Maaden stock will decline in 2024 compared to the current price, ending the year at an average price of 43.496 SAR. And it reaches 66.618 SAR in 2028.

7. RIYAD stocks (Tadawul: 1010) - One of the best financial Saudi stocks in 2026

Riyad Bank is a commercial bank and a leading financial institution in Saudi Arabia. Offering diverse banking services and ranked fourth in assets, Riyad is considered a solid Saudi stock with a steady growth in the last years.

Riyad Bank is forecast to grow earnings and revenue by 6.2% and 9.4% per annum respectively. EPS is expected to grow by 6.3% per annum. Return on equity is forecast to be 14.7% in 3 years.

“Tadawul: 1010”, a company that pays dividends, has a current yield of 5.41% that is well covered by earnings.

Analysts suggest that the price of Riyad Bank stock will increase in 2024 compared to the current price, ending the year at an average price of 30.136 SAR. And it reaches 45.244 SAR in 2028.

8. Bank Albilad stocks (Tadawul: 1140) - another top Saudi stock from the banking sector

Bank Albilad was founded in 2004 and is headquartered in Riyadh, the Kingdom of Saudi Arabia. Bank Albilad is a leading financial institution in Saudi Arabia, known for its strong presence and commitment to customer satisfaction. With strategic partnerships, innovative services, and a focus on digital transformation, it offers a trusted and convenient banking experience for individuals and businesses alike.

Bank Albilad is forecast to grow earnings and revenue by 11.7% and 12.2% per annum respectively. EPS is expected to grow by 11.6% per annum. Return on equity is forecast to be 16.2% in 3 years.

Bank Albilad is a dividend paying company with a current yield of 1.12% that is well covered by earnings.

Analysts suggest that the price of Bank Albilad stock will growth in 2024 compared to the current price, ending the year at an average price of 47.310 SAR. And it reaches 73.262 SAR in 2028.

9. Alinma stocks (Tadawul: 1150) - one of the best shares in the Saudi market

Alinma Bank is a leading financial institution in Saudi Arabia, providing a wide range of banking and financial services to individuals, businesses, and government organizations. Established with a strong presence in the country, Alinma Bank is recognized as one of the prominent banks in Saudi Arabia. Alinma became one of the most speculated Saudi stocks for local and international investors between 2021 and Q1 2022 when its price gained around 200%.

Alinma Bank is forecast to grow earnings and revenue by 10.5% and 12.2% per annum respectively. EPS is expected to grow by 10.4% per annum. Return on equity is forecast to be 17% in 3 years.

Alinma Bank is a dividend paying company with a current yield of 2.88% that is well covered by earnings.

Analysts suggest that the price of Alinma Bank stock will grow n 2024 compared to the current price, ending the year at an average price of 40.466 SAR. And it reaches 68.122 SAR in 2028.

10. Saudi Electricity Stock (Tadawul: 5110) - one of the best Saudi stocks

Saudi Electricity Company was incorporated in 2000 and is headquartered in Riyadh, the Kingdom of Saudi Arabia. Saudi Electricity Company (SEC) is a leading entity in Saudi Arabia's energy sector, providing reliable electricity generation, transmission, and distribution services. With strategic partnerships and a focus on digital transformation, Saudi Electricity ensures efficient power supply and contributes to the country's development.

Saudi Electricity is forecast to grow earnings and revenue by 42.4% and 4.6% per annum respectively. EPS is expected to grow by 30.8% per annum. Return on equity is forecast to be 10.9% in 3 years.

Saudi Electricity is a dividend paying company with a current yield of 3.62% that is well covered by earnings.

Analysts suggest that the price of Saudi Electricity stock will growth in 2024 compared to the current price, ending the year at an average price of 20.694 SAR. And it reaches 26.386 SAR in 2028.

Are these the best Saudi stocks to invest in right now?

Not necessarily. These are some of the best Saudi stocks to watch in 2023 based on analyst coverage, and defensive and recovery opportunities. But that doesn't mean that they're the best Saudi stocks to invest in. Predicting the future of even the current top-performing Saudi stocks is a job even the pros haven’t yet mastered. And the best stocks to buy for your portfolio aren’t necessarily the best stocks for someone else’s portfolio.

For example, a young person who is looking to grow their retirement savings aggressively might gravitate toward growth stocks for their high-risk, high-reward volatility. On the other hand, a retiree who is looking for passive income might prefer predictable dividend stocks like the dividend aristocrats, which are relatively stable and have a history of consistently growing their dividend payments over time.

How to find the best Saudi stocks to buy now?

Choosing good stocks for your portfolio is a relatively time-consuming task, and you need to look beyond performance metrics like the ones on this page. Yes, it's a solidly good sign if a stock can outperform during periods of market volatility and the broad market declines like we've seen in 2022. But as referenced above, there are several other factors to consider.

Beyond your own personal risk tolerance and how long you plan to invest, strategic investors do significant research into a company before buying its stock. They perform fundamental analysis, which involves looking at the company's financial statements and considering how economic factors might influence the stock's future performance.

Many investors also do technical analysis of a stock, which means analyzing historical movements in the stock's price to attempt to predict future movements. If you want to go this route, we have detailed overviews of how to buy stocks and how to trade stocks, including key terms to know.

An alternative to chasing the best Saudi stocks to buy now

If all the above sounds like a lot of work, it is. The fact that picking Saudi stocks is so difficult leads many investors to turn to exchange-traded funds (ETFs), which bundle many Saudi stocks together.

When individual stocks come together into a diversified portfolio via index funds, they have a lot of power: The MSCI Saudi Arabia Investable Market Index (IMI) is designed to measure the performance of the large, mid and small-cap segments of the Saudi Arabia market. The index incorporates foreign ownership limit restrictions. With 110 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in Saudi Arabia.

An MSCI Saudi Arabia Investable Market Index (IMI) index fund or ETF will aim to mirror the performance of the index by investing in the companies that make up that index. Likewise, investors can track the index with an index fund tied to that benchmark. If you want to cast a wider net, you could purchase a total stock market fund, which will hold thousands of stocks.

Within index funds, the winners balance out the losers — and you don’t have to forecast which is which. That’s why many financial advisors think low-cost index funds and exchange-traded funds should form the basis of a long-term portfolio.

Investing in Saudi Stocks via iShares MSCI Saudi Arabia ETF (KSA)

Are you looking to invest in the companies shares from a well-established country that is undergoing economic transformation? When the iShares MSCI Saudi Arabia ETF (NYSE ARCA: KSA) launched in 2015, investors gained an easy way to access broad exposure to the country. The fund is a market-cap-weighted index that tracks the broad-based index composed of Saudi Arabian equities. The ETF is traded on the NYSE and is an iShares product powered by BlackRock.

Top 10 Holdings in the Saudi Arabia Fund

Al Rajhi Bank Saudi National Bank Saudi Arabian Oil Saudi Basic Industries Saudi Telecom Saudi Arabian Mining Alinma Bank Riyad Bank Bank Albilad Saudi Electricty 12.21% 8.20% 6.16% 5.66% 5.43% 4.72% 3.19% 3.05% 1.85% 1.33%

Why Invest in Saudi stocks via KSA?

- Access to the Saudi Arabian stock market and get exposure to a country with growth potential.

- Launched in 2015, the investment fund is approaching $1B in assets under management.

- The average annual return since inception is 8.4%, while the average of the last 3 years is 19.84%.

Final words on the best Saudi stocks

Before you consider some of the best Saudi stocks listed here, you'll want to hear this.

If you're starting on your investing journey (or if you want a sanity check), please read through our how-to-invest in stocks guide. It goes through all the basics, from how to get started to how to determine your personal investing strategy, to how much of your money to invest in stocks.

Although analysts are bullish on each of these stocks and think they are good Saudi stocks to buy right now, they might not all be the best choices for investors who don't yet have established and diversified portfolios. Even the most stable companies on this list aren't immune to volatility in their stock prices, especially over short periods.

For this reason, if you're just getting started, you'll also want to consider a well-diversified option like the iShares MSCI Saudi Arabia ETF (NYSE ARCA: KSA) or the Saudi market index TASI.

Free resources

Before you start investing in the best stocks for your portfolio, you should consider using the educational resources we offer like CAPEX Academy or a demo trading account. CAPEX Academy has lots of trading courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make more-informed investment decisions.

Our demo account is a suitable place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how leveraged trading works – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.